The dividend payout ratio is the ratio of dividends to net income, and represents the proportion of net income paid out to equity holders. A dividend is a payment of a share of the profits of a corporation to its shareholders. Dividends for a corporation are the equivalent of owners drawings for a non-incorporated business.

Related AccountingTools Courses

- Retained earnings are the increase in the firm’s net assets due to profitable operations and represent the owners’ claim against net assets, not just cash.

- Instead, it creates a liability for the company, as it is now obligated to pay the dividends to its shareholders.

- They are a distribution of the net income of a company and are not a cost of business operations.

- The frequency and amount of dividends paid are determined by the company and normally follow regular patterns, such as quarterly or annually.

Stock dividends involve distributing additional shares of the company’s stock to existing shareholders. Unlike cash dividends, stock dividends do not impact the company’s cash balance. When a stock dividend is declared, the company debits Retained Earnings and credits Common Stock and Additional Paid-In Capital accounts. The amount transferred from retained earnings is based on the fair market value of the additional shares issued. This process increases the total number of shares outstanding, which can dilute the value of each share but does not affect the overall equity of the company.

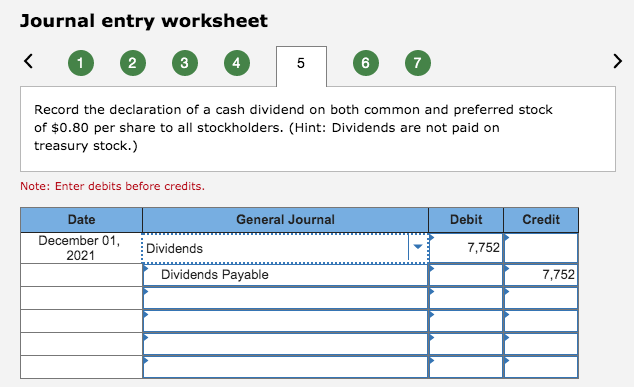

Cash Dividend

This entry reflects the reduction in retained earnings, which represents the portion of profits being distributed, and the creation of a liability that the company must settle. Cash dividends are corporate earnings that companies pass along to their shareholders. On the day the board of directors votes to declare a cash dividend, a journal entry is required to record the declaration as a liability. A company’s like-kind exchange board of directors has the power to formally vote to declare dividends. The date of declaration is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. Cash and property dividends become liabilities on the declaration date because they represent a formal obligation to distribute economic resources (assets) to stockholders.

What is the approximate value of your cash savings and other investments?

Some companies issue shares of stock as a dividend rather than cash or property. This often occurs when the company has insufficient cash but wants to keep its investors happy. When a company issues a stock dividend, it distributes additional shares of stock to existing shareholders. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. The company can make the cash dividend journal entry at the declaration date by debiting the cash dividends account and crediting the dividends payable account. Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits.

The board of directors determines the amount of the dividend, and the company must declare a dividend before it can be paid. In addition, stock dividends transfer a part of retained earnings to permanent capital. This is referred to as capitalizing retained earnings and makes that part of retained earnings transferred to permanent capital unavailable for future cash dividends. As a stock dividend represents an increase in common stock without any receipt of cash, it is recognized by debiting retained earnings and crediting common stock. The amount at which retained earnings is debited depends on the level of stock dividend, i.e. whether is a small stock dividend or a large stock dividend.

So Many Dividends

When a company declares a stock dividend, this does not become a liability; rather, it represents common stock the company will distribute to shareholders, so it’s reflected in stockholders’ equity. The company basically capitalizes some of its retained earnings, moving it over to paid-in capital. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. This is due to, in many jurisdictions, paying out the cash dividend from the company’s common stock is usually not allowed. And of course, dividends needed to be declared first before it can be distributed or paid out. Assuming there is no preferred stock issued, a business does not have to pay dividends, there is no liability until there are dividends declared.

Most mature and stable firms restrict their cash dividends to about 40% of their net earnings. In fact, dividends are not paid out of retained earnings; they are a distribution of assets and are paid in cash or, in some circumstances, in other assets or even stock. The announced dividend, despite the cash still being in the possession of the company at the time of the announcement, creates a current liability line item on the balance sheet called “Dividends Payable”. At the same time as the dividend is declared, the business will have decided on the date the dividend will be paid, the dividend payment date. The process involves specific journal entries that must be meticulously recorded to ensure accuracy in financial statements.

Understanding how dividends are accounted for is essential for both investors and financial professionals, as it impacts the overall financial health and reporting of an organization. To see the effects on the balance sheet, it is helpful to compare the stockholders’ equity section of the balance sheet before and after the small stock dividend. As noted, this is often referred to as capitalizing retained earnings, because a portion of retained earnings becomes part of the firm’s permanent invested capital. In effect, after the stock dividend, each individual shareholder owns the same proportionate share of the corporation as he or she did before. After all these entries have been made, total stockholders’ equity remains the same, because there has not been a distribution of cash or other assets. There are a number of reasons that a corporation may issue a stock dividend rather than a cash dividend.